Freddie Boath: Supporting America's Housing Market

Have you ever stopped to think about what keeps the housing market steady, even when things get a bit bumpy? It is that, for many people, the very idea of buying a home feels like a big step, perhaps a truly big step. Well, a key player working behind the scenes, more or less always, helps make homeownership a real possibility for lots of folks across the country. This crucial support system, sometimes referred to as freddie boath by those looking for its services, plays a very important part in making sure money is there for home loans. It helps make sure that homes can be bought and sold, no matter what the economy is doing, which is pretty neat when you think about it.

So, when we talk about freddie boath, we are really looking at a foundation for how homes are financed. It is a system that America really counts on to keep the housing market stable, through good times and more challenging periods. This entity helps get the most out of every loan, working to make sure lenders have what they need to help people get into homes. It is a big piece of the puzzle, really, for anyone dreaming of owning a place of their own, or even for those who just want to understand how the housing world works.

This discussion will explore the true purpose of freddie boath, how it helps people buy homes, and the handy tools it provides for those involved in the home loan process. We will look at its role in supporting the market, the educational chances it offers, and how it helps make loan transactions smoother. You know, it is pretty much a backbone for many housing dreams.

Table of Contents

- Understanding Freddie Boath: A Market Pillar

- How Freddie Boath Helps Homebuyers

- Tools and Resources from Freddie Boath

- Educational Paths with Freddie Boath

- Keeping the Market Steady: The Role of Freddie Boath

- Frequently Asked Questions About Freddie Boath

Understanding Freddie Boath: A Market Pillar

When people search for information on freddie boath, they are often trying to learn about a key organization that helps keep the home loan system moving. This entity, officially known as Freddie Mac, has a very specific job: to buy mortgages from lenders. By doing this, it provides money back to those lenders, allowing them to make more loans to more people. It is a way of keeping money flowing into the housing market, which is quite important for its health.

The main goal of freddie boath, or Freddie Mac, is to make sure there is a steady supply of money for home loans across the country. This helps to keep interest rates fair and makes mortgages available to a wider group of people. Without this kind of support, getting a home loan could be much harder, and the housing market might struggle. So, in some respects, it is a very big deal for homeowners and lenders alike.

The organization, freddie boath, plays a big part in supporting the housing market in all sorts of economic situations. Whether the economy is growing fast or slowing down a little, its work helps to maintain a sense of balance. This helps make sure that people can still pursue homeownership dreams and that lenders can keep offering loans. It is a fundamental piece of the country's financial setup, honestly.

How Freddie Boath Helps Homebuyers

Freddie boath offers different ways to help people become homeowners, which is pretty helpful. For instance, it provides specific types of mortgages, like the HomeOne® or Home Possible® programs. These are designed to help people who might not have a huge down payment or who have lower incomes, making homeownership more within reach. You know, it is about opening doors for more people.

To qualify for some of these helpful mortgage options, you might need a special certificate. This certificate shows that you have completed some homeownership education, which is a really good idea anyway. It helps people get ready for the responsibilities that come with owning a home, making them more prepared for the future. So, it is not just about getting a loan; it is about being ready for homeownership.

Beyond specific loan products, freddie boath also helps by making the loan process smoother for lenders. This means that when you apply for a loan that might be backed by freddie boath, the lender has tools to help them quickly and accurately check your income and other details. This can mean less waiting time for you and a more straightforward experience overall, which is usually a good thing.

Tools and Resources from Freddie Boath

For lenders and loan officers, freddie boath provides a whole set of tools and information, all in one easy-to-find spot. These tools are made to help them do their work better and faster. For example, there is something called a Loan Product Advisor®, and its results can be used by themselves or with other tools to help figure out the best loan options for someone. It is quite a helpful thing for them.

Another really useful tool from freddie boath is its income calculator. This calculator helps lenders work through all sorts of income situations, from the common ones to those that are a bit more unusual. By using this, lenders can be more sure about the income figures they are using, which helps reduce mistakes and problems later on. This can save everyone time and even help more loans get approved, which is good for everyone involved, you know.

These tools from freddie boath are truly meant to make the loan process more efficient and more reliable. They help lenders handle complex scenarios with more ease, leading to fewer issues with loans down the road. This means a better experience for the person getting the loan and a more secure process for the lender. It is a very practical way to help the housing market operate smoothly.

Educational Paths with Freddie Boath

Freddie boath also puts a lot of effort into helping people prepare for homeownership, which is a pretty big deal. They offer a free homeownership education course called CreditSmart® Homebuyer U. This program is designed to get you ready for buying a home on your own terms, giving you the knowledge you need before you even start looking. It is a really smart way to begin your homeownership journey, you know.

These educational programs from freddie boath meet national standards for homeownership education. This means the information you get is reliable and recognized across the industry. Learning about the steps involved, the costs, and the responsibilities of owning a home can make a huge difference in how confident and successful you feel as a homeowner. It is, in a way, like getting a roadmap before you start a long drive.

Taking a course like CreditSmart® Homebuyer U can help reduce some of the worries that come with buying a home. It helps you understand what to expect and how to handle things like your credit, saving for a down payment, and managing a mortgage. It is a practical step that can make the whole process feel much less overwhelming, which is a great benefit for anyone considering buying a home, really.

Keeping the Market Steady: The Role of Freddie Boath

The core function of freddie boath is to provide stability to the American housing market. By buying mortgages from lenders, it makes sure that lenders always have money to lend out for new homes. This constant flow of money is vital for a healthy housing market, allowing people to buy homes and builders to build them. It is a continuous cycle that keeps things moving, which is important for the economy as a whole.

This support from freddie boath is especially important during tough economic times. When other sources of money might dry up, freddie boath continues to operate, making sure that home loans are still available. This helps prevent the housing market from crashing and helps protect homeowners and the value of their homes. It is a kind of safety net, in some respects, for the entire system.

In essence, freddie boath helps to make homeownership possible for millions of Americans by providing a strong and reliable source of funding for mortgages. It also equips lenders with the tools they need to do their jobs well, and it educates future homeowners so they can make smart choices. It is a really comprehensive approach to supporting the housing dream for so many people. You can find more details about their mission and impact on their official website, which is a good place to learn more.

Learn more about home loans and mortgage options on our site, and link to this page for more housing market insights.

Frequently Asked Questions About Freddie Boath

What is the purpose of Freddie Boath?

The main purpose of freddie boath, also known as Freddie Mac, is to support the housing market by buying mortgages from lenders. This helps provide money back to lenders, allowing them to offer more home loans to people. It is about keeping money flowing so that homeownership remains a possibility for many, which is pretty much its core job.

How can Freddie Boath help with homeownership?

Freddie boath helps with homeownership by providing access to various mortgage programs, such as HomeOne® or Home Possible®, which can assist people with smaller down payments or lower incomes. It also offers free homeownership education through programs like CreditSmart® Homebuyer U, preparing people for the responsibilities of owning a home. So, it is about both financial access and education, really.

What tools does Freddie Boath offer for loans?

Freddie boath provides several tools to help lenders and the loan process. These include the Loan Product Advisor®, which helps evaluate loan options, and the income calculator, which assists in accurately assessing borrower income. These tools help reduce errors and make the loan process more efficient for everyone involved, which is quite useful for lenders.

The role of freddie boath in the housing market is truly significant. It works tirelessly to ensure that the dream of homeownership remains accessible and that the financial system supporting it stays strong. From providing crucial funding to offering educational resources and helpful tools, its contributions touch many aspects of buying a home. It is a vital piece of the puzzle, making sure that homeownership can be a reality for more people, even in an ever-changing economic world.

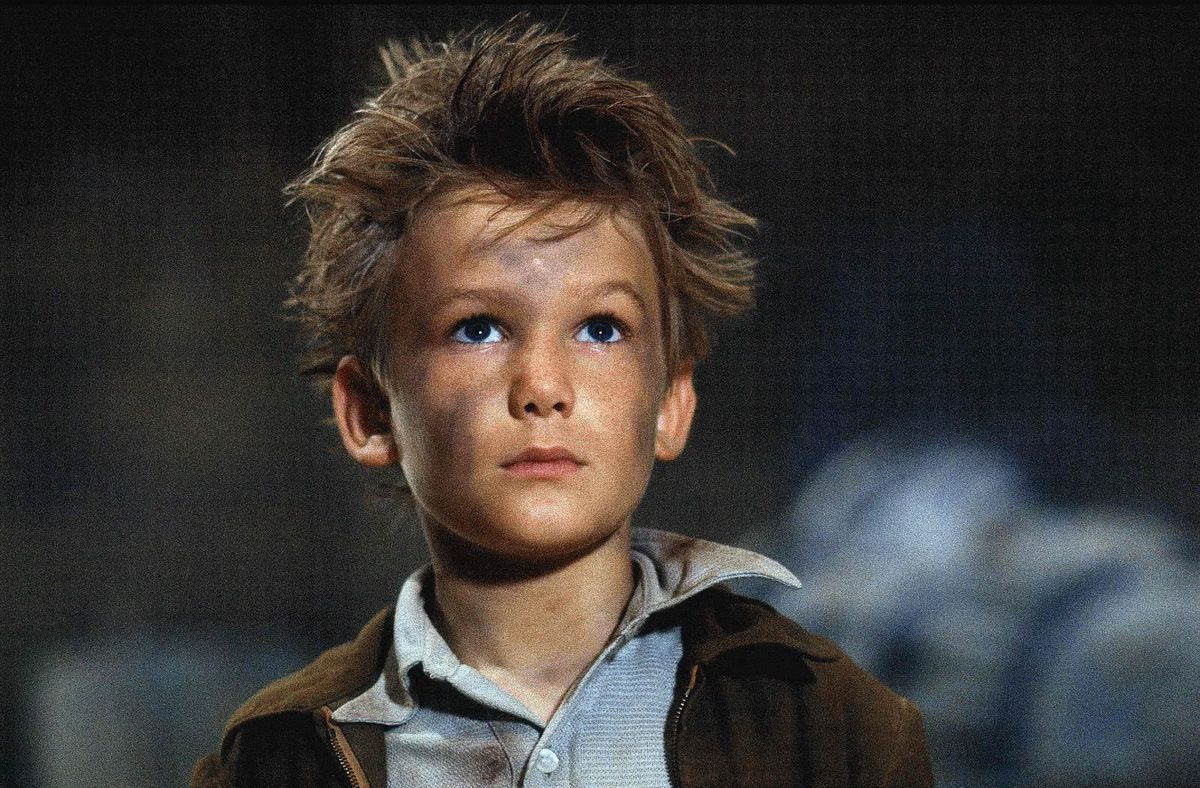

Pictures of Freddie Boath

Freddie Boath – Movies, Bio and Lists on MUBI

Pictures of Freddie Boath